Investing in Antiques and Collectables: A Brief Guide.

Introduction

Hi, my name is Gregory Ebbs, and I am an avid and passionate antiques collector. My parents sparked my interest in antiques by buying me a 200-year-old musket instead of a games console for my 10th birthday. That gift ignited a lifelong passion, and now, nearly two decades later, I have acquired a sizable collection of various items. I have also been fortunate enough to profit from many years of enthusiasm and pursue both undergraduate and postgraduate degrees in the topics that interest me most: military history.

Given the uncertain future we live in, marked by conflicts such as the war in Ukraine, economic challenges in the UK, and the ongoing threat of climate change, many investors are increasingly concerned about how to safeguard their wealth for future generations. In this climate of instability, finding reliable investment opportunities that offer both financial security and growth potential has become a pressing priority for many. In my nearly 20 years of experience, I have found antiques to be very rewarding both financially and mentally. This article shares some thoughts of mine and some tips I’m happy to offer when buying, selling, and investing.

Personal Experience: Rise and Fall of the Antiques Market

Certain industries, such as militaria, have sky-rocketed in price. For example, a musket from the IMA cache of Kathmandu, circa 1840, which was for sale for £100 in 2010, can be valued between £800 - £1000 in the present-day market. World War II items have increased considerably, with wartime-dated battledress that was previously on sale for tens of pounds at various car boot sales becoming increasingly scarce and hard to come by. Royal Marine or Parachute Regimental battledress now fetch £800+ in the present market.

However, brown furniture, glass, ceramics, and watercolour paintings have seen quite a tumble in recent years. Despite the record low prices, I strongly believe these items will bounce back. The next generation of youth is becoming increasingly environmentally conscious and is actively seeking ways to decarbonise our environmental footprint. Recycling is one of our most effective methods for reducing waste, and I believe many of today's youth have not yet fully grasped how much money and carbon they can save by buying old, second-hand items instead of new retail products. Investing in antiques not only offers the potential for financial gain but also aligns with sustainable practices that can contribute to a greener future. The early 2000s was a time of record growth but also waste, and this culture of waste, I believe, will change.

The Art, Antiques and Collectors Market Statistical Growth

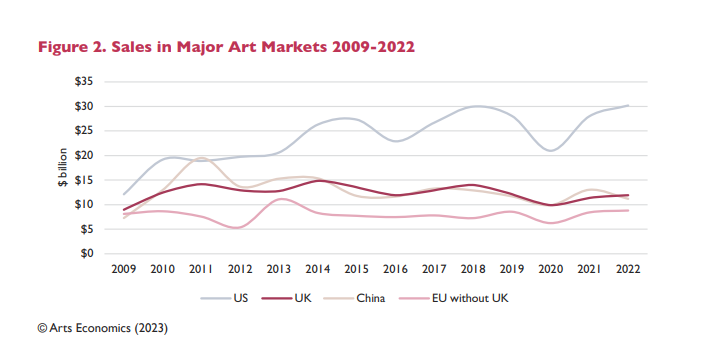

Statistically, the British art market is one of the largest trading hubs, worth an estimated £9.7 billion, second only to New York. Since 2019, dealers and businesses have grown in number by 14%, with estimated global auction sales totaling £4.1 billion, 42% of which originate from the UK. Although the UK’s market has seen a slight decline in sales over the last decade due to Covid and Brexit, global sales have skyrocketed. In the US, the art market was worth £12.5 billion in 2009 and has since grown to over £30 billion in 2022. Although trends cannot be calculated from the Office of National Statistics alone, the growth of the antiques, art, and collectables industry can be clearly followed.

Why You Should Invest in Antiques, Art and Collectables?

Everyone’s reasons for investing in the antiques market differ. For me, I feel far more comfortable buying physical objects rather than investing money in stocks. To make money from this industry, I caution all prospective buyers to do their homework, study the topic in depth, and watch out for fakes. Various antique-related TV shows portray antiques as an easy industry to break into, but to become very successful, you need to pursue a niche and study that topic in great depth.

In return, expect a truly rewarding hobby and investment. Antiques aren’t just about buying material objects and holding onto them for prolonged periods of time. It’s also about learning and studying the past. Feeling and holding objects that are 100+ years old and might be the sole example of their type is a unique experience. Every object is different and has a story, and when you buy an object, you are physically buying a piece of history, sometimes nationally significant.

In contrast to stocks, shares, or bitcoin, antiques are physical. Should the market take a downward spiral, at least you own an item that you care about and value. Many people buy objects purely for their monetary value, but I caution against this. I strongly recommend newcomers pursue and invest in antiques they value both intrinsically and financially.

Some Tips

Personally, I have found British collectors and dealers to be increasingly out of pocket due to a nationally difficult financial situation caused by Covid, Brexit, Ukraine, and a cost of living crisis. However, new markets have been emerging in recent years from South East Asia, America, Canada, and Australia. I do not recommend any dealer or collector to only buy antiques and sell items without the use of the internet. In a digital age, it’s incredibly important to have a strong online presence in order to tap into foreign markets and maximize selling potential. When selling, always be careful when using auctions and digital platforms. UK auctions on average charge between 13-18%, but this trend has been changing with the more successful auctions charging clients up to 40% to both buyers and sellers. The same goes for online auction marketplaces, which have various commission fees ranging from 12% upwards.

Conclusion

Investing in antiques and collectables offers a unique and rewarding alternative to traditional financial investments like stocks, shares, and bitcoin. While these markets can be volatile and intangible, antiques provide a tangible connection to history and culture, offering both financial potential and personal fulfillment. My nearly 20 years of experience have shown that with thorough research, a focus on niches, and an appreciation for the intrinsic value of objects, antiques can be a stable and profitable investment.

Despite the challenges posed by economic instability, the antiques market has demonstrated resilience and growth, especially in certain sectors like militaria. Moreover, as society becomes more environmentally conscious, the appeal of sustainable practices such as buying and preserving antiques is likely to increase.

For those considering entering this market, it is essential to stay informed, leverage digital tools to access global markets, and remain cautious of fakes and high commission fees. By valuing antiques both intrinsically and financially, collectors can find joy in the process and security in their investments.

Antiques are more than just financial assets; they are pieces of history that tell stories and connect us to the past. Embracing this unique blend of investment and hobby can lead to a truly enriching experience, both personally and economically.

Author: Gregory Ebbs

Founder of Raven Yard AntiquesAntiques For Sale

SEE MORE

Product ID: 28

A 9ct Gold Five Emerald And Diamond Ring..., For Sale

Buy It Now: £285

Product ID: 29

A 9ct Gold With Sapphire And Diamond Cl..., For Sale

Buy It Now: £280

Product ID: 37

An 18ct Gold Solitaire Diamond Ring., For Sale

Buy It Now: £950

Product ID: 38

A 9ct Gold Two Coloured Cultured Pearl N..., For Sale

Buy It Now: £390

Product ID: 39

A 9ct Gold Two Coloured Cultured Pearl N..., For Sale

Buy It Now: £190

Product ID: 41

A White Metal With Sapphire And Diamond..., For Sale

Buy It Now: £420

Product ID: 42

A 9ct Gold Amethyst Ring., For Sale

Buy It Now: £250

Product ID: 43

A 9ct Gold Cultured Pearl, Sapphire, Rub..., For Sale

Buy It Now: £550